This report is designed to help companies, investors, and founders track the trends and benchmarks established by venture capital leaders.

Updated monthly, our report and database provide verified data and expert insights.

We examine the activities of the largest and most experienced firms — the technologies and sectors they support, and the types of investments they make. We believe that a deeper understanding of the priorities held by venture capital market leaders can help our subscribers more effectively build their investment and growth strategies.

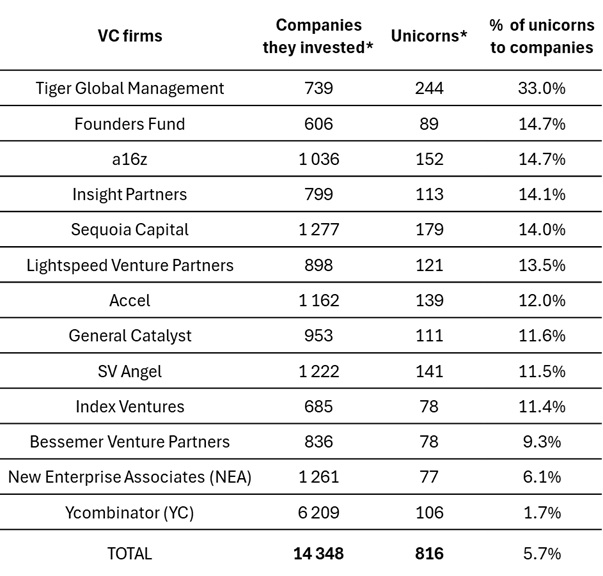

The VC companies we analyze are smart money – they backed more than 800 companies, which became unicorns or even decahorns.

According to our calculations, because of their role in the ecosystem and their smart approach, the leaders reach almost around 15% unicorns to their portfolio.

Key facts (January 2026)

190 deals (5.1% from total January 2026 deals)

142 deals from 190 were leaded by this 13 venture firms, in other 48 deals, the firms participated in syndicates.

Syndicates with top VC included 9.8 bn USD mn (not including megadeals)

Top VC supported 22 of January unicorns (66% from 33 unicorns according to Dealroom Unicorns)

The report based on 190 deals concluded or announced with the participation of these companies in January 2026— approximately 5.1% of the total number of venture investments for the month. 142 deals from 190 were leaded by this 13 venture firms, in other 48 deals, the firms participated in syndicates.

In January 2026, the top venture funds backed 52.1% of Pre-Seed / Incubator stage rounds and 10% of Seed stage rounds.

The total share of VC backed by top firms: Pre-Seed, Incubator, and Seed rounds backed by major VC firms is 62%, which is the highest level in recent months (compared to 51% in September, 56% in October 2025).

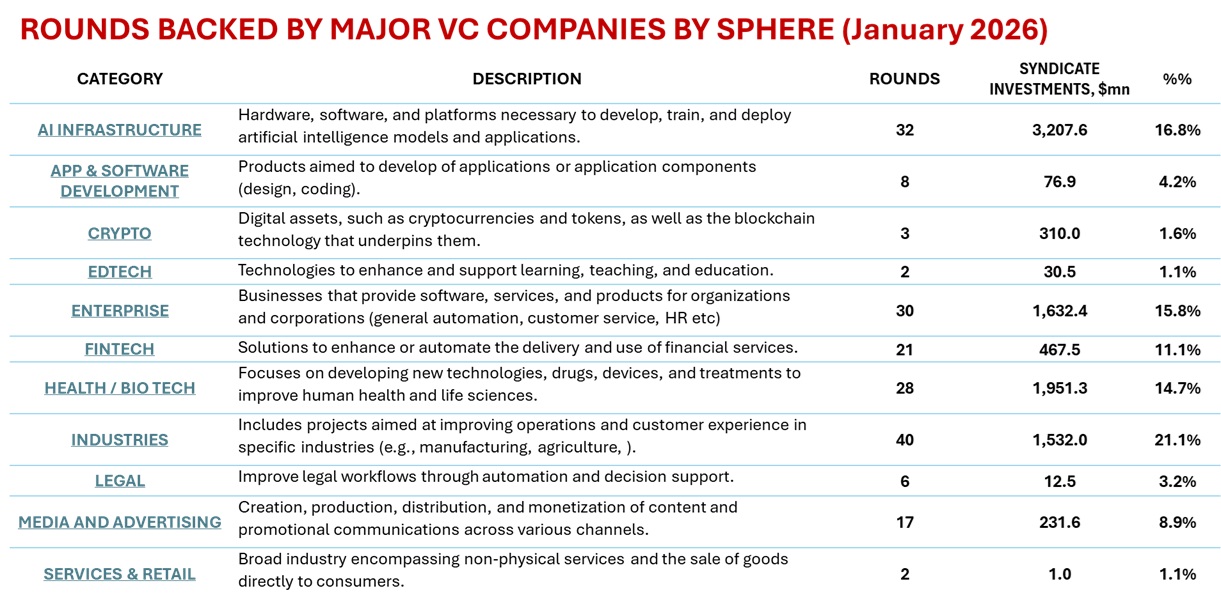

The largest proportions of Pre-Seed and Seed rounds were observed in Legal (100%, 6 total), Media & Advertising (67%), AI Infrastructure (67%).

Still January 2026 syndicates (lead or participated by lead VC), reached 6.8 bn USD.

The data on the number of deals (Rounds) continues to show a level below last year January (-18% compared to January 2025 with 3,745 deals versus 4,586 and -37% compared to January 2024).

The share of new Pre-Seed / Seed rounds has declined to 27-28%, one of the lowest levels in recent years (January 2026 – 30.4%).

Almost all new startups supported by market leaders are implementing or using AI. This represents a very high barrier to entry and places high demands on the team.

AI integration has become virtually mandatory for startups. As of January 2026, 88% of Pre-Seed startups, 100% of Seed-stage startups, and 87% of Early-stage companies either use or have announced the use of AI in their products.

AI Infrastructure

AI infrastructure category includes hardware, software, and platforms necessary to develop, train, and deploy artificial intelligence models and applications.

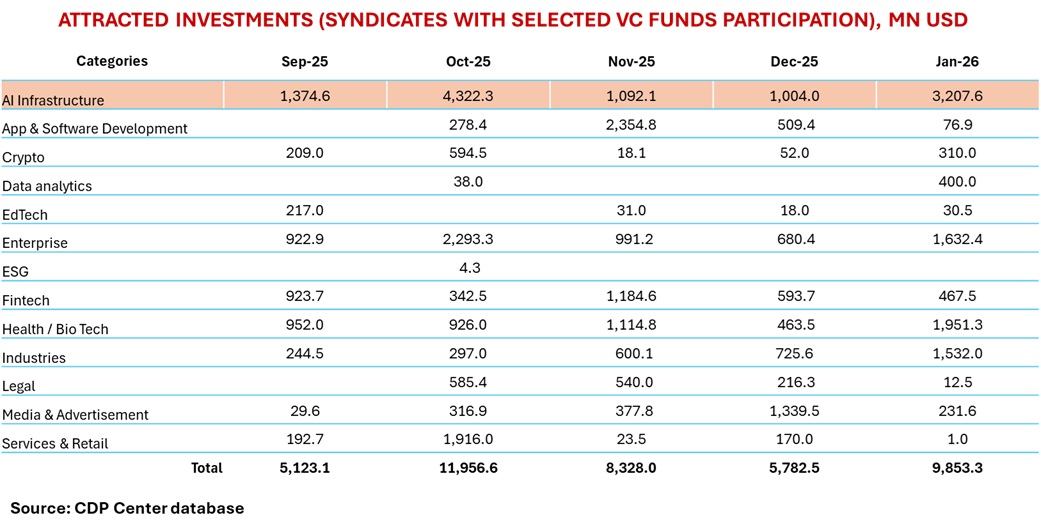

In terms of investment volume, AI Infrastructure remains a high-conviction, high-capital sector, often leading the market in total dollars raised. After a massive peak in October 2025 where it secured over $4.32 billion, the sector saw a cooling period toward the end of the year, dipping to its lowest point in December at roughly $1.00 billion. However, January 2026 marked a significant resurgence with $3.21 billion in attracted investments—a more than 3x increase from the previous month. This suggests that while individual deal sizes fluctuate, the sector continues to capture a massive share of total VC participation, accounting for nearly a third of the total $9.85 billion invested across all categories in the most recent month.

The quantity of deals in AI Infrastructure shows a high level of volatility but a strong upward trajectory for the start of 2026. Activity spiked from a mere 5 deals in September 2025 to 33 in October, followed by a period of relative stability with 17 and 18 deals in November and December, respectively. The data for January 2026 shows a near-return to peak activity with 32 deals. When comparing the deal count to the total money raised, the average deal size in January 2026 was approximately $100.2 million, indicating that the sector isn't just seeing more activity, but is consistently attracting "round" style investments compared to more fragmented categories.

According to our monthly analytical report “Startup Report: Venture Funds Deals and Trends”* in January, 18% funding rounds by 13 leading venture capital funds were directed toward projects supporting the development and practical application of artificial intelligence technologies.

It is interesting to note that the majority of projects in this category that received funding in January 2026 were founded in 2025 (23 out of 30). Meanwhile, two projects were founded in 2026—specifically in January—and secured funding within that same month.

Additionally, out of the 6 companies that achieved unicorn status in January 2026, 4 received funding and reached a market value of over $1 billion while still at the Early Stage. We especially would like to particularly highlight unicorn LMArena (backers include a16z, Lightspeed Venture Partners) which created platform for benchmarking LLMs via human-led side-by-side battles. Skild AI aimed on developing a general-purpose AI brain for robots that uses massive scaling to enable autonomous physical movement across diverse hardware. Ricursive Intelligence (Lightspeed Venture Partners, Sequoia, Radical AI, NVentures) aimed at AI self-improvement, with a focus on chip design.

The undisputed leader in attracting significant Early-Stage capital was Humans&, in subcategory “Applied, Interactive & Research AI” securing $480 million (Empathetic AI technologies designed to amplify human collaboration and connection through long-horizon reinforcement learning models. Their target customers include global enterprises, government agencies, and diverse communities seeking human-centric, multi-agent AI solutions).

Additionally, two other projects within the “Compute & Systems Optimization” subcategory attracted substantial Early-Stage funding:

Recursive Intelligence - $300 million (New technology of recursive self-improvement for AI via task-specific reasoning strategies with min data points and compatible with existing LLMs. The company targets enterprises and AI product teams seeking to solve complex business problems that standard language models struggle to handle).

Upscale AI - $200 million (An open-standard networking platform and custom silicon designed specifically to optimize and scale high-performance AI workloads. Their target customers include hyperscale data centers, AI infrastructure operators, and enterprises building large-scale GPU clusters for AGI).

Investors have shown high activity in specific subcategories, effectively funding projects that are creating entirely new markets:

AI Development & Agent Frameworks- this subcategory consistently draws high investor interest, accounting for 10 out of the 30 projects in the AI Infrastructure category.

The "Compute & Systems Optimization" and "Data & Knowledge" subcategories each saw 7 projects funded. The "Interactive & Research AI Infrastructure" subcategory saw 5 projects.

Notably, "Interactive & Research AI Infrastructure" has the fewest early-stage startups, with only 2 out of 5 projects being at the Pre-Seed stage.

As for “Data & Knowledge Infrastructure” in this subcategory, investors continue to actively support projects focused on creating new models and interaction systems between data providers and consumers—essential for the evolution of AI models. This accounts for 5 out of 7 projects in the subcategory, with the majority of these currently at the Pre-Seed stage.

Startups in the AI Infrastructure category that received funding from venture capital market leaders at the Pre-Seed and Seed stages warrant particular attention and interest. These projects launched across all four subcategories:

AI Development & Agent Frameworks: Polymath, Moda, Oximy, Jinba, Sentrial, Salus, RadixArk, Inferact.

Applied, Interactive & Research AI: Traverse, Ishiki Labs, and Poetiq.

Compute & Systems Optimization: Chamber, Cumulus Labs, Compresr, Voxel Energy, and Condor Energy.

Data & Knowledge Infrastructure: Orthogonal, ARC Prize Foundation, Shofo, Human Archive, and VOYGR.

All of the startups secured $0.5 million at the Pre-Seed stage. Notably, two startups at the Seed stage, Poetiq and Inferact raised a substantial funding for this round:

Inferact: $150 million (Optimizing the inference phase with advanced AI infrastructure (base on vLLM), for deploying high-performance models at scale. The company targets AI application developers, infrastructure teams, and enterprises seeking to run diverse workloads efficiently across hardware).

Poetiq: $45.8 million (Developed a new technology for recursive self-improvement in AI via task-specific reasoning strategies. This approach requires minimal data points and remains compatible with existing LLMs. The company targets enterprises and AI product teams seeking to solve complex business problems that standard language models struggle to handle.)

If you are interested in information about venture industry insights and current funding trends, subscribe to our monthly reports here: venture.cdp.center

Each report covers trends in 14 categories (AI Infrastructure, App & Software Development, Crypto, Data analytics, EdTech, Enterprise, ESG, Fintech, Health / Bio Tech, Industries, Legal, Media & Advertisement, Science & Research, Services & Retail) and database of startups backed by leading 13 venture capital firms(a16z - Andreessen Horowitz, Sequoia Capita, YC - YCombinator, Index Ventures, Founders Fund, Bessemer Venture Partners, Insight Partners, Accel, Lightspeed Venture Partners, General Catalyst, New Enterprise Associates (NEA), Tiger Global Management, SV Angel)

The detailed data on the rounds is presented in the full report.

DISCLAIMER: This report analyzes market trends and is not a source of definitive or complete data. Due to the dynamic nature of the market, it's impossible to provide 100% accurate, allencompassing data. Our research is based on the information we have gathered through different public sources, and it may be corrected as new data becomes available. Investing in startups is inherently challenging and carries significant risks. This report should not be construed as investment, tax, or legal advice. We are not making any recommendations. If you are considering starting a business or making venture investments, you should consult with qualified professionals, who can provide personalized and competent advice.